Boulder home prices remain steady in face of uncertainty

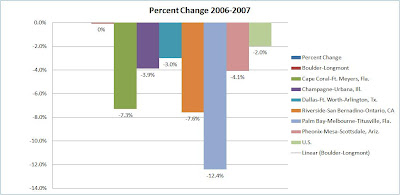

While many

Recent numbers from IRES shows existing-home prices within the city of

Ken Hotard, vice president of public relations for the Boulder Area Realtor Association (BARA), attributed the local market’s strength to the absence of rapid appreciation of home values in past years that occurred along the nation’s coasts.

“We never really did have a bubble,” he says.

“Basic economics 101 will tell you that simple supply and demand plays a role here,” he says, noting

A recent study of

In other words, the city’s residents’ median income of $80,000 would not support the median home price, he says. In fact, 30 percent of all homeowners in the city of

Nonetheless, Boulder-area homes are not appreciating as much as they have in years past because of the slower economy and less job growth, Hotard says.

“There’s been some but there hasn’t been like there was in the ’90s,” he says.

From 1990 to 2000, the average appreciation of

Hotard says a 4 percent to 6 percent appreciation rate represents a healthy, sustainable market that makes purchasing real estate a wise long-term investment.

A 3 percent appreciation rate, though not as good, reflects a stable market, he says.

“That covers inflation,” Hotard says. “You’re not losing money but you’re not gaining much.”

Hotard predicts that the appreciation rate will remain stable and relatively unchanged until 2009 or 2010 in the absence of economy-impacting positive or negative events.

Once a new president and Congress are in place in 2009, it will take a while until it is clear how those changes will affect the real estate market, Hotard says.

Posted by BoulderRealEstate at 11/26/2007 09:51:00 AM

Boulder’s economy remains steady

The

Source: Milken Institute/Greenstreet Partners’ 2007 Best Performing Cities

Source: Milken Institute/Greenstreet Partners’ 2007 Best Performing Cities

Posted by BoulderRealEstate at 11/14/2007 01:59:00 PM

Summit County Real Estate

Our featured vacation destination for November is Summit County, Colorado. Summit County is a unique area that includes four world-class ski areas, beautiful Lake Dillon and year-round fun family activities in the White River National Forest. The recent trend in appreciation of resort homes makes purchasing a vacation property in Summit County an appetizing option.

Our featured vacation destination for November is Summit County, Colorado. Summit County is a unique area that includes four world-class ski areas, beautiful Lake Dillon and year-round fun family activities in the White River National Forest. The recent trend in appreciation of resort homes makes purchasing a vacation property in Summit County an appetizing option.

The official third quarter stats are in and the Summit County average sales price is up 20.61 percent! Some of the higher areas are Breckenridge with a 22.25 percent increase, Silverthorne and Wildernest with a 26.99 percent increase, and Keystone with a 31.24 percent increase in average sales price. These are big, big – very big - increases.

Think about it this way: last year, someone could have picked up resort property here for an average cost of $433,380. This year that same average cost is at $522,682 – or $89,302 more. In 2005 that average would have been $377,000, and in 2004 the year-end average sale price for Summit County was $336,343!

Those who have purchased property in Summit County have not only enjoyed living there over the past few years but some substantial gains in the value of their property, as well. With that said, three years from now looking back over our shoulders at the average sale price for 2007, 2008 and 2009 will be ...

Don't wait any longer; take this opportunity to talk to your RE/MAX of Boulder agent about vacation properties in Summit County.

Posted by BoulderRealEstate at 11/14/2007 12:12:00 PM

Boulder rental market sizzles in midst of mortgage cool-down

While stricter mortgage-lending requirements and stagnant appreciation rates have all but put the brakes on some real estate markets, the rental market is full-speed ahead – especially in

“It’s very hot,” says Sheila Horton, executive director of the Boulder Area Rental Housing Association. “It’s been a very solid market. It’s the strongest market we’ve seen in several years.”

How hot is it?

Horton says people are already asking to pre-lease units for next year, when renters don’t usually start leasing until January or February.

“I think the mortgage problems have caused people to reconsider the value of living in an apartment,” she says.

Colorado Apartment Insights LLC reports that the south

With fewer people moving out of rentals and into their own homes, combined with growing enrollment at the

“That has a big impact in our market,” she says, noting the university’s sophomore class had about 500 more students than the class before when they entered as freshmen.

By nature of its high cost of living,

“Current statistics say about 53 percent of everyone who lives in

“There are certainly rental properties on the market,” she says, from single-family houses to large complexes, for those who want to get in on the rental action while it’s hot.

What investors should understand if they buy property in

Posted by BoulderRealEstate at 11/14/2007 10:25:00 AM

Buyers want cool homes with big garages and room to play

According to the 2006 National Association of Realtors’ Profile of Buyers’ Home Feature Preferences survey, staying cool still tops the list; however, a backyard or play area and high-speed Internet access broke into the top nine features and oversize garages grew in popularity since the last survey in 2004. Here’s a look at the home features most desirable to buyers: Source: National Association of Realtors research

Source: National Association of Realtors research

Posted by BoulderRealEstate at 11/12/2007 01:49:00 PM

Boulder Lofts

Lofts in Downtown Boulder Move Quickly New buildings featuring mixed uses on the downtown Boulder landscape have become a common occurance. First it was Boulder One Plaza, then the St. Julien, then 1505 Pearl and 1155 Canyon. Construction on The Walnut at 1655 Walnut Street is slated to begin this month, and numerous other projects are in the planning process. This upscale market – which includes a reported appreciation rate of as much as 50 percent, immediate access to Pearl Street Mall’s restaurants and shops, and proximity to hiking trails, all mixed with a new found hint of big-city life – is attracting more Boulder residents and vacationers. The developing urban environment, which still encompasses the hometown feel and sense of community Boulder is known for, presents a compelling argument for buyers to explore the options downtown living offers.

New buildings featuring mixed uses on the downtown Boulder landscape have become a common occurance. First it was Boulder One Plaza, then the St. Julien, then 1505 Pearl and 1155 Canyon. Construction on The Walnut at 1655 Walnut Street is slated to begin this month, and numerous other projects are in the planning process. This upscale market – which includes a reported appreciation rate of as much as 50 percent, immediate access to Pearl Street Mall’s restaurants and shops, and proximity to hiking trails, all mixed with a new found hint of big-city life – is attracting more Boulder residents and vacationers. The developing urban environment, which still encompasses the hometown feel and sense of community Boulder is known for, presents a compelling argument for buyers to explore the options downtown living offers.

With an extremely limited supply and a huge demand, these condos are selling fast: nine of 34 units of The Walnut are already under contract. Prices of units in the building range from $500,000 to $3.5 million. The inventory of lofts at 1155 Canyon, priced between $400,000 and $5 million, sold out within a week. Purchasers in this market range from young professionals to “downsizers” and vacation-property owners. With high rental rates and excellent appreciation, downtown condominiums offer great investment potential, as well. Because of the discrepancy between supply and demand, this area of the market is insulated from the rest of Boulder and has remained strong even while new construction everywhere else has slowed. Things here are only getting better: the developers are striving to create a higher-quality product, incorporating green building practices, and bringing in acclaimed architects such as Mark Harbick from Huntsman Architectural group in San Francisco to design The Walnut.

$3.5 million. The inventory of lofts at 1155 Canyon, priced between $400,000 and $5 million, sold out within a week. Purchasers in this market range from young professionals to “downsizers” and vacation-property owners. With high rental rates and excellent appreciation, downtown condominiums offer great investment potential, as well. Because of the discrepancy between supply and demand, this area of the market is insulated from the rest of Boulder and has remained strong even while new construction everywhere else has slowed. Things here are only getting better: the developers are striving to create a higher-quality product, incorporating green building practices, and bringing in acclaimed architects such as Mark Harbick from Huntsman Architectural group in San Francisco to design The Walnut.  The trend in Boulder is moving toward that of a vacation destination with limited prime real estate available, so now is the time to buy. Do not miss the chance to own a piece of truly luxury living in downtown Boulder before it’s too late. It is an exciting time to buy downtown Boulder real estate. Contact us to assist you in exploring the benefits of downtown luxury condominium living today!

The trend in Boulder is moving toward that of a vacation destination with limited prime real estate available, so now is the time to buy. Do not miss the chance to own a piece of truly luxury living in downtown Boulder before it’s too late. It is an exciting time to buy downtown Boulder real estate. Contact us to assist you in exploring the benefits of downtown luxury condominium living today!

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/12/2007 09:10:00 PM

Mortgage Crisis?

Local Lenders Provide Insight on Mortgage Crisis The mortgage lending waters have been a little unpredictable predict lately, to say the least.

The mortgage lending waters have been a little unpredictable predict lately, to say the least.

Lou Barnes, a mortgage banker and an owner of Boulder West Financial Services Inc., described the mortgage crisis phenomenon as “a panic on the far side of Wall Street among investors who were buying loans that were far too risky and have now decided not to buy at all.”

The virtual shutdown happened so quickly and so completely that it’s starving the marketplace of needed credit, he said, leaving companies such as American Homes bankrupt and Countrywide Financial treading water just to stay in business.

“This is a dangerous thing,” Barnes said. “It’s one of those rare financial events that is a sign of trouble in the financial system and a cause of trouble in the financial system.”

trouble in the financial system and a cause of trouble in the financial system.”

However, the crisis hasn’t cut off all mortgage loans. What it has done is virtually wiped out subprime loans, made to those with poor credit, and increased rates for “jumbo” loans more than $417,000 that government programs such as Fannie Mae and Freddie Mac will not purchase.

“All of the traditional products are unchanged,” he said. “They’re just as available as they ever were.”

Stated-income and no-documentation loans are difficult to find, and the safest interest rate lock comes from banks or bank-affiliated mortgage brokers, Barnes said.

“We haven’t had to draw back near to the extent other funding sources have,” agreed Karen Woolhiser, sales manager for Wells Fargo Home Mortgage in Boulder. “We’ve been known as a conservative lender, and it’s the right way to do business.”

Wells Fargo still offers 100 percent financing, interest-only and stated-income loans, but the interest rate on those products are higher than traditional loans, Woolhiser said.

And the bank has enough in assets to make jumbo loans at a reasonable rate and maintain them until pricing improves and the bank can sell them, she said.

Woolhiser said the lending market has also changed in that it no longer is advantageous to get an adjustable-rate mortgage, as rates on those are as high – if not higher – than those on a 30-year fixed-rate mortgage.

Although the crisis is cleansing the industry of unqualified borrowers and lenders, it is an overcorrection of overgenerous lending practices that will have a profound effect on the economy and market, Barnes said.

“The credit pendulum has been on too easy for nearly 10 years,” he said. “It was swinging gently toward sensible swing until (the second week of August, when it) went as far as it possibly could to oth-er side. The housing market has become conditioned to availability, and to take them away all at once is unquestionably a shock. “We’re too far away to predict” the impact the crisis will have, Barnes added. “We need to see whether or not and what kind of recession we’ll have. … I think the psychological damage is worse than the financial damage. If you were bombarded everyday about foreclosures and mortgage meltdowns, it tends to make you want to avoid the subject. One symptom would be backing away from the market and doing something else.”

“We’re too far away to predict” the impact the crisis will have, Barnes added. “We need to see whether or not and what kind of recession we’ll have. … I think the psychological damage is worse than the financial damage. If you were bombarded everyday about foreclosures and mortgage meltdowns, it tends to make you want to avoid the subject. One symptom would be backing away from the market and doing something else.”

Woolhiser said she has observed that the local market is slowing, but since it usually does as summer ends, it’s hard to say if it is a result of the crisis or just “that time of year.”

Barnes predicted that Colorado should survive the “meltdown” better than other states, but “the sales data takes time; we won’t really know the impact even nationally until October, when we get September’s sales data.”

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/11/2007 09:04:00 PM

Boulder Green Points

City of Boulder looks to update Green Points Program The city of Boulder was one of the first jurisdictions in the nation to impose a residential “green” building code. Now it’s looking to raise the green bar even higher.

The city of Boulder was one of the first jurisdictions in the nation to impose a residential “green” building code. Now it’s looking to raise the green bar even higher.

The city’s Green Points Building Program for residential construction, which encourages homeowners to include cost-effective and sustainable remodeling and building methods that protect the environment, hasn’t been updated since 2001. The program applies to all new residential construction and additions and remodels larger than 500 square feet.

Elizabeth Vasatka, environmental coordinator for City of Boulder’s Office of Environmental Affairs, said staff is proposing the city:

· Adopt the 2006 International Energy Conservation Code and require new homes be 50 percent more efficient than the code’s standard.

· Require homeowners remodeling or adding to their house get a home-energy audit before they get a building permit. The audit, remodeling or adding to their house to get a home-energy audit before they get a building permit. The audit, which can be subsidized through the city-sponsored Residential Energy Audit Program, will educate homeowners about energy-saving opportunities they can incorporate into their project. City staff is proposing to make some of those opportunities mandatory.

energy-saving opportunities they can incorporate into their project. City staff is proposing to make some of those opportunities mandatory.

· Require remodeling or addition projects to meet standard building codes and earn Green Points to receive a building permit.

· Require contractors donate, reuse or recycle a minimum of 65 percent of an existing structure and 50 percent of construction waste by weight on a new job site.

“We’re somewhat helping folks future-proof themselves for the next 20 to 30 years,” Vasatka said.

Staff is recommending the city help market homes that have met or exceeded the requirements of the program by assisting homeowners in obtaining the federal tax credit; providing a certificate indicating Green Points required and achieved; and serving as a liaison to the Boulder County MLS real estate listing agency to implement Green Points or green building features into the database to assist in marketing properties, Vasatka said.

The city council will vote on the changes in mid-November. If passed, the new requirements will likely become effective in January.

For Mary Lou Robles, an architect and sustainability consultant with Studio Points in Boulder, it’s about time the city upgrades the Green Points Program.

“It’s not a choice anymore,” she said. “There have been enough shifts in the environmental climate that it’s up to us to rethink what and how we build. It’s only logical that the jurisdictions rethink their role and the requirements they place on building. “There (are) benefits to be had by doing the right thing. (The requirements are) all completely doable and they’re all within economical reach.”

“There (are) benefits to be had by doing the right thing. (The requirements are) all completely doable and they’re all within economical reach.”

But Kim Calomino, director of Built Green Colorado, Boulder city officials do not know what the 2006 energy code can accomplish, so they shouldn’t try to raise the bar and instead should wait for more green-friendly standards now being worked into the national building code.

The market – not government regulations – should drive green building, Calomino said.

“There’s a fine balance between setting requirements that are cost effective, keeping homes affordable at point of purchase and over the long haul, and requiring homes to be built in such a way that it knocks them out of reach for a lot of folks,” she said.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/11/2007 08:52:00 PM

Boulder Market - still something to offer

Boulder Market has Home-buying and Investment Opportunities  The national real estate market has received a fair amount of negative attention lately. Consequently, it is understandable that Boulder County property owners are wondering how all of this negativity affects our local market. Buyers are reportedly taking their time to decide and are in no hurry to make purchases, while some sellers are generally out of touch with what is going on in this market. Although the national real estate market has been negatively impacted, Boulder is unique and doesn’t fit the traditional mold of a city or of other real estate markets across the country.

The national real estate market has received a fair amount of negative attention lately. Consequently, it is understandable that Boulder County property owners are wondering how all of this negativity affects our local market. Buyers are reportedly taking their time to decide and are in no hurry to make purchases, while some sellers are generally out of touch with what is going on in this market. Although the national real estate market has been negatively impacted, Boulder is unique and doesn’t fit the traditional mold of a city or of other real estate markets across the country.

Although Boulder is seeing the effects of a market slowdown, agents at RE/MAX of Boulder believe now is the time to buy. Fewer people are looking to buy homes than in the past, but more sellers in the market means buyers have a better inventory of homes from which to choose. As a result, prices have softened and sellers have even dropped the price of their homes to sell them. In some cases homes can sit on the market for six to nine months, especially higher-priced homes. Agents are recommending sellers pay to stage their homes, as experience has shown that homes that “shine” and are priced competitively will sell faster.

choose. As a result, prices have softened and sellers have even dropped the price of their homes to sell them. In some cases homes can sit on the market for six to nine months, especially higher-priced homes. Agents are recommending sellers pay to stage their homes, as experience has shown that homes that “shine” and are priced competitively will sell faster.

Although the market is not as strong as in years past right now, some positive signs show an upward trend may be on the horizon. Statistics from IRES LLC show that prices have softened, but Boulder real estate has continued to appreciate over the last two years while surrounding areas have suffered. There is a growing trend of people transferring here for new jobs, which means more buyers in the marketplace. Sellers are taking homes off the market and renting them out to take advantage of a strong rental market. With homes coming off the market, the amount of inventory will start to decline. All of these factors demonstrate why our market is unique and emphasize the point – even though the press has been reporting that nationally values will continue to drop, our market will hold its own. Under these market conditions RE/MAX agents see opportunities for both buyers and investors alike. The rental market is strong; there are quality tenants and rising rental rates. Thus smart investors are buying income properties while the market is slow and it is still difficult for buyers to get financing. Some agents predict buyers will find good deals through the first of January and the market will make a comeback in 2008 for a stronger year. Remember, they advise, Boulder remains a desirable place to live and an excellent place to own real estate. With its proximity to the mountains, temperate climate, high quality of life, abundant open space and limited future development potential, Boulder County will always have a greater demand than supply for homes. Therefore the values should continue to rise in the long term. Don’t miss this opportunity to buy; contact your RE/MAX agent today!

Under these market conditions RE/MAX agents see opportunities for both buyers and investors alike. The rental market is strong; there are quality tenants and rising rental rates. Thus smart investors are buying income properties while the market is slow and it is still difficult for buyers to get financing. Some agents predict buyers will find good deals through the first of January and the market will make a comeback in 2008 for a stronger year. Remember, they advise, Boulder remains a desirable place to live and an excellent place to own real estate. With its proximity to the mountains, temperate climate, high quality of life, abundant open space and limited future development potential, Boulder County will always have a greater demand than supply for homes. Therefore the values should continue to rise in the long term. Don’t miss this opportunity to buy; contact your RE/MAX agent today!

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/09/2007 07:15:00 PM

Bankrate's - Increase the value of your home

Value of home upgrades?

When trying to decide what upgrades to make to a home before putting it on the market, consider Bankrate.com’s list of 20 changes – 10 for the better and 10 to the detriment – that can alter the value of a home:

Increase home's value

3) A well-appointed master suite

5) Curb appeal

6) A light, airy, spacious feel

7) Good windows

8) Landscaping

10) Basement

1) A pool

2) No garage or small garage 4) Outmoded appliances or systems

4) Outmoded appliances or systems5) Stale or overly personal decor

6) A bad roof7) Bad location

8) Poor maintenance10) A long list of needed home improvements

Posted by BoulderRealEstate at 9/09/2007 07:00:00 PM

Rock Creek - Home & Community

Find a Home and a Community in Rock Creek Are you looking for a home in Boulder County but having trouble finding one that meets all of your needs? Rock Creek, the master-planned community located in Superior and adjacent to Flatiron Crossing Mall, may be the diamond in this rough market for which you have been looking. This community has a wide variety of options for single-family homes ranging in price from $299,000 to $1.2 million. Other options, such as condos and townhomes, also exist; this wonderfully designed community has something for everyone. With the location, amenities, and recent market slowdown, this is the perfect time to explore all of the potential deals within Rock Creek. RE/MAX of Boulder is very familiar with this subdivision and your agent would be happy to help you explore the opportunities available you within it.

Are you looking for a home in Boulder County but having trouble finding one that meets all of your needs? Rock Creek, the master-planned community located in Superior and adjacent to Flatiron Crossing Mall, may be the diamond in this rough market for which you have been looking. This community has a wide variety of options for single-family homes ranging in price from $299,000 to $1.2 million. Other options, such as condos and townhomes, also exist; this wonderfully designed community has something for everyone. With the location, amenities, and recent market slowdown, this is the perfect time to explore all of the potential deals within Rock Creek. RE/MAX of Boulder is very familiar with this subdivision and your agent would be happy to help you explore the opportunities available you within it.

Rock Creek’s location and amenities make it one of the most desirable places to live in Boulder County. The neighborhood is situated just minutes east of Boulder off of U.S. 36 and is within half of an hour of downtown Denver, as well. One of the benefits of the Boulder County address is access to Boulder Valley School District schools. With two excellent schools in the community, Superior Elementary and Eldorado K-8, it is an ideal place to raise a family. Residents of Rock Creek report feeling a strong sense of community because of the homes’ proximity to the schools and a variety of other activities, such as concerts, parades and pool parties sponsored by the active HOA within Rock Creek. Amenities include two pools, an extensive trail system, pocket parks, and a community park with baseball fields and a newly completed turf field. Flatiron Crossing Mall, dining, shopping, and movie theatres are all within walking distance of Rock Creek. With the great location and array of amenities, it is easy to see why people who buy in Rock Creek typically stay in Rock Creek.

activities, such as concerts, parades and pool parties sponsored by the active HOA within Rock Creek. Amenities include two pools, an extensive trail system, pocket parks, and a community park with baseball fields and a newly completed turf field. Flatiron Crossing Mall, dining, shopping, and movie theatres are all within walking distance of Rock Creek. With the great location and array of amenities, it is easy to see why people who buy in Rock Creek typically stay in Rock Creek.

What does this mean for you? Whether you are a buyer or an investor, you can find potential deals within Rock Creek. This subdivision provides access to the benefits of luxury living with a Boulder County address at a discounted price. Although a fair amount of inventory is on the market, the demand for homes in Rock Creek is strong, with the most activity directed toward homes priced at less than $350,000. Although sales are slower for homes in the $500,000-plus range, homes that are priced well and on nice lots are still selling. With a good rental market, increasing rental rates, decreasing availability of single-family homes at reasonable prices in Boulder, and the sense of community as well as access to amenities in Rock Creek, it is the time for you to explore the many options available in this subdivision. Contact your RE/MAX of Boulder Realtor today. RE/MAX of Boulder, Inc. offers some advice to buyers and sellers: Although this is a buyer’s market, sellers don’t have to give their homes away. Houses that are priced well are still selling between 60 and 90 days in most instances. People who have lived in Rock Creek have had the opportunity to experience how great living in this community really is. A demand for housing in great communities with a plenty of amenities and excellent schools will always exist. Rock Creek is that community and plenty of buyers are actively looking now.

RE/MAX of Boulder, Inc. offers some advice to buyers and sellers: Although this is a buyer’s market, sellers don’t have to give their homes away. Houses that are priced well are still selling between 60 and 90 days in most instances. People who have lived in Rock Creek have had the opportunity to experience how great living in this community really is. A demand for housing in great communities with a plenty of amenities and excellent schools will always exist. Rock Creek is that community and plenty of buyers are actively looking now.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/09/2007 06:38:00 PM

Loft Development in Northern Colorado

Loft-style Developments Infiltrate Northern Colorado Communities Infill developments and redevelopments featuring loft-style residences over businesses are breathing new life into Northern Colorado communities’ downtowns.

Infill developments and redevelopments featuring loft-style residences over businesses are breathing new life into Northern Colorado communities’ downtowns.

And similar units are providing the “live” element for the live-work-play scenario offered in proposed new developments, as well.

In the last four years, the inventory of loft-style residences has grown to nearly 800 units throughout Fort Collins, Loveland and Greeley.

Eric Nichols, a broker with Realtec Commercial Real Estate Services in Fort Collins who has been involved in three downtown loft projects, said the demand for loft-style dwellings is primarily coming from baby boomers retiring or planning to retire soon. They are buying lofts as their second homes or making them their primary homes and getting rid of the bigger homes they had built for their children and pets.

“They want to lock the door and disappear for a few months, especially in the winter time,” he said.

Many loft dwellers want to live where the “intellectual energy” and strong cultural environment are concentrated – which is near Colorado State University, performing arts venues and other amenities in or coming to downtown Fort Collins, Nichols said.

“With that type of a venue, you walk out your front door and down the street, you have dinner at one of many venues, go to a performance and have cocktails afterward” without ever needing a car, he said.

The boomers are the target market developer McWhinney expects to attract to its Grand Station development within Centerra at I-25 and U.S. 34 in Loveland, said Chris LaPlante, vice president of mixed-use development for McWhinney.

“We’ve got a lot of interest from folks in that profile,” he said.

Though both LaPlante and Nichols said they expect the loft-style residences to appeal to young professionals of the “Y” generation, Nichols said that market has yet to show much of an interest in them. With prices ranging from $250,000 to more than $1.5 million, with the majority going for $400,000 to $650,000, that generation may have yet to find secure employment since the downsizing within the high-tech industry, he said. Yet he expects a more even split of the market between boomers and Gen Y over the next decade.

Mike Jensen, broker/owner of Fort Collins Real Estate who lists 170 of Fort Collins’ loft units, said he is seeing interest from folks from every stage and walk of life, from undergraduates and graduates who purchase lofts with their parents, young professionals and young families to single people in their 40s and retirement-bound baby boomers. He said lofts he lists are selling for between $275,000 and $450,000, with the most activity in the $300,000 to $350,000 range.

“There’s this trend of people moving back into the urban city centers for a lifestyle,” he said.

During a recent shopping center conference, Jensen said he learned that in 1990, about 72 percent of the nation’s population was living outside of urban centers, or a 1-mile radius of downtowns, but in 2010, more than 50 percent of the population will live within that radius.

“That’s millions and millions of people,” he said. “Lofts and infill development projects are really the wave of the future.”

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/09/2007 06:00:00 PM

Kauai - Island of Beauty and Opportunity

Kauai: An Island without Equal Of all the Hawaiian islands, Kauai - the oldest and most remote island of the major archipelago - stands apart. Though other islands may bow to familiarity, Kauai remains a mystery - one part exotic nature, one part independent spirit - all wrapped in bountiful experiences found nowhere else on earth. To be on Kauai is to touch the soul of a distant and ancient country while still enjoying the close and comfortable embrace of the mainland. Breathe in the haunting majesty of serrated mountains and tumbling seas. Fall under the spell of seductive colors, scents and seasons. Savor her wild nature.

Of all the Hawaiian islands, Kauai - the oldest and most remote island of the major archipelago - stands apart. Though other islands may bow to familiarity, Kauai remains a mystery - one part exotic nature, one part independent spirit - all wrapped in bountiful experiences found nowhere else on earth. To be on Kauai is to touch the soul of a distant and ancient country while still enjoying the close and comfortable embrace of the mainland. Breathe in the haunting majesty of serrated mountains and tumbling seas. Fall under the spell of seductive colors, scents and seasons. Savor her wild nature.

Kauai is an adventure for the mind, body and soul. Tour the National Botanical Tropical Gardens, one of the settings for the movie "Jurassic Park," and enjoy a dazzling display of rare and endangered flora. Discover the enchanting beauty of the Na Pali Coast and the charm of historic island towns. Enjoy the cultural and music festivals of Kauai. Savor traditional island cuisine at a variety of distinctive restaurants. Engage in the many island adventures Kauai has to offer: Zodiac trips to secluded beaches; a 17-mile cruise to view Ni'ihau, Hawaii's forbidden island; whale watching in the winter season; surfing on Po'ipu Beach; Wailua River kayak excursions among hidden falls and ancient rainforests; outrigger rides; helicopter tours; and a sunrise downhill bike tour through Koke's State Park.

trips to secluded beaches; a 17-mile cruise to view Ni'ihau, Hawaii's forbidden island; whale watching in the winter season; surfing on Po'ipu Beach; Wailua River kayak excursions among hidden falls and ancient rainforests; outrigger rides; helicopter tours; and a sunrise downhill bike tour through Koke's State Park.

If this island paradise sounds appealing, it is time to look into second-home options on this one-of-a-kind island in the Pacific. The definite hot spots are future retirement estates and resort area properties in Poipu and Princeville, but single-family homes are moving, as well. Appreciation is up from last year and interest rates are still relatively low. Purchasers can feel secure that Hawaii is a safer purchase than some other vacation destinations: buying property in the U.S. is inherently less risky than purchasing in some of the third-world destinations gaining popularity in recent years. Property buyers in Hawaii don't have to worry about traveling on foreign airlines, neighboring countries experiencing civil unrest, or clouds on their property titles. Kauai's future is bright as no other warm tropical areas in the U.S. compare to the beauty and uniqueness of Kauai.

Exciting opportunities in both single-family homes and resort communities are available on Kauai.  The cornerstone project of this developing world-class resort community- is a 1,100 acre planned community called Kukuiula. Developed by DMB Inc., Kukuiula is said to be the Beverly Hills of the Islands with an unprecedented level of luxury. Kukuiula has lots starting at $1.3 million and cottages from $2.2 million. Two other up-and-coming projects are Koloa Landing, with condos ranging from $900,000 to $1.8 million, and The Royal Palms, with prices slated for $850,000 to $1.5 million. Let one of the members at our affiliate office on Kauai show you all that this lovely island has to offer. Please remember that we can put you in touchwith Realtors your can trust, anywhere in the world.

The cornerstone project of this developing world-class resort community- is a 1,100 acre planned community called Kukuiula. Developed by DMB Inc., Kukuiula is said to be the Beverly Hills of the Islands with an unprecedented level of luxury. Kukuiula has lots starting at $1.3 million and cottages from $2.2 million. Two other up-and-coming projects are Koloa Landing, with condos ranging from $900,000 to $1.8 million, and The Royal Palms, with prices slated for $850,000 to $1.5 million. Let one of the members at our affiliate office on Kauai show you all that this lovely island has to offer. Please remember that we can put you in touchwith Realtors your can trust, anywhere in the world.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 9/08/2007 10:09:00 PM

McMansions

McMansions on the Chopping Block? Residents of unincorporated Boulder County may soon no longer be able to build homes as big as their dreams.

Residents of unincorporated Boulder County may soon no longer be able to build homes as big as their dreams.

The county commissioners are expected to vote this fall on regulations they believe would mitigate the impact of large homes on the county’s rural character and resources.

At the July 10 meeting, the commissioners asked staff to draft regulations that would prevent homeowners from building homes on the plains bigger than between 6,500 and 7,000 square feet or from adding on to existing homes to make them bigger than that without purchasing development rights/credits. For the mountains, residents would have to purchase development rights/credits to build or expand homes that would exceed between 4,500 and 5,000 square feet. Both proposed sizes include garages and basements and are about twice as big as what was previously proposed.

The move comes as the median size of a new home in unincorporated Boulder County grew from 5,189 square feet in 2004 to more than 8,000 square feet this year.

The commissioners’ argument is that bigger homes – even those built using green building techniques – are still not sustainable because of the amount of resources associated with both their construction and on-going use, said Michelle Krezek, manager of special projects for the county. As such, those homeowners should have to off-set that resource use by buying development rights/credits that allow the county to purchase open space elsewhere.

County staff members also are researching unique thresholds for Special Character Areas, such as Gold Hill, Eldora and Allenspark, as the board wants to provide them with particular protection, Krezek said.

The commissioners also want to allow property owners who either have or want smaller homes the opportunity to not only sell a portion of their “unused” square footage for a one-time payment, but also have lower ongoing tax assessments on their smaller homes, she said. Doing so will diversify the housing stock and allow people of “varied means” to own homes in Boulder County.

Krezek said the growth of the median size of new homes, along with homeowners substantially adding onto a smaller home – such as building a 6,000-square-foot addition on to a 2,000 square-foot home – or demolishing an existing home to replace it with a much bigger home, is affecting the diversity of housing in the county.

However, the proposed regulations are meeting a fair amount of opposition. Many homeowners, concerned with how the regulations will affect their ability to build their dream home or add on to their existing homes, have spoken against the proposal. But Ken Hotard, senior vice president, public affairs, of the Boulder Area Realtor Association, said the issue goes beyond individual property rights to the appropriate process for addressing the problem.

But Ken Hotard, senior vice president, public affairs, of the Boulder Area Realtor Association, said the issue goes beyond individual property rights to the appropriate process for addressing the problem.

“I frankly don’t know whether they should or shouldn’t do something like this,” he said, noting the county already has significant control over home size through zoning, planning review and other regulations.

“Tools exist today that if they were revised they could materially affect home size in an appropriate context that is in relationship” to neighboring properties and the character of the area, Hotard said. Go to http://www.baraonline.com/news/insite/y2007/july/wk12/n1181770336_360399 for more of Ken Hotard's position on the proposed "McMansion regulations.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 8/01/2007 08:45:00 PM

IBM - New Gunbarrel Facility

IBM Boulder expands data center

Just what the expansion of IBM’s Boulder facility's for a “green” data center will mean for the community in terms of future employment is still not known.

But what city and state officials and economic experts do know is that the expansion will bury IBM’s anchor deeper into the economic waters of the community.

The $86 million project involves retrofitting 80,000 square feet of an existing 100,000-square-foot building on IBM’s campus to data center space, said Dan Willis, spokesman for IBM Boulder. Combined with the existing 225,000-square-foot data center, it will be one of IBM’s largest data centers in the world.

The center will use high-density computer systems with virtualization technology, as well as IBM’s Cool Blue portfolio of energy-efficient power and cooling technologies. This, along with energy-efficient design and construction, will reduce the center’s impact on the environment, thus earning it the title of “green” data center.

Willis said since some of IBM Boulder’s existing 3,400 employees will work in the data center and the company is still determining who will work on what projects, how many new workers IBM will need to hire once the center is built out in April 2008 is still in question. Data centers are not labor-intensive, and an expansion does not require as many additional employees as a new company opening or relocating, Willis said.

Nonetheless, “this is a major investment by IBM in the Boulder site," he said. “We hope that it will bode well in the future for both projects and jobs.”

Frances Draper, executive director of the Boulder Economic Council, said despite the unknown job impact, IBM’s investment is substantial for the community.

“For them to build it here is huge because they’re on the forefront of what IBM is doing and they successfully competed” for the expansion, she said. “The fact that they’ve agreed to put $86 million into this community is putting a huge anchor in for IBM and shows that they’re willing to invest” and would likely invest again in the Boulder site.

“It is a very good anchor that they’ve put down.”

The center will allow IBM Boulder to handle “mega, mega, mega data of companies,” she said. “It really changes the dynamic of the kind of business they can take on.”

The fact that the city of Boulder agreed to give IBM a $100,000 rebate through its pilot business incentive program and the Colorado Office of Economic Development and International Trade awarded IBM $632,000 and will work with IBM to establish a training program for the new data  center work force proved that the community cares about having IBM here and made a big impression on company executives, Draper said.

center work force proved that the community cares about having IBM here and made a big impression on company executives, Draper said.

And Boulder will see the impact of the new data center through the multiplier effect as visitors from the company and its customers visit to check out the “showcase” data center or to work on projects, she said. Those visitors will spend money on hotel rooms, food and more, and the center could lead to more suppliers and spin-off companies locating in the area.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 8/01/2007 08:41:00 PM

Northern Colorado Growth

Small communities lead state in growth-

NoCo towns at the top

Two of Northern Colorado’s small towns garnered the top slots for the fastest-growing communities in thestate from July 1, 2005, to July 1, 2006, according to the latest figures released by the U.S. Census Bureau.

Severance in Weld County topped the list, growing from an estimated 1,978 people in 2005 to 2,590 in 2006,or nearly 31 percent. Wellington, north of Fort Collins in Larimer County, grew by an estimated 661 residents, or 19 percent. Its population reached 4,128 last year and was the second fastest-growing Colorado community ranking. Other Northern Colorado communities experiencing double-digit growth included Johnstown, 13.3 percent; Frederick, 11.74 percent; and Firestone grew by nearly 10 percent in the same period.

In Boulder County, Erie grew from an estimated 12,307 to 14,125, or nearly 15 percent, while Lyons experienced the second-highest growth in the county from 2005 to 2006 with 8.5 percent.

At the county level, Boulder grew from 279,508 residents to 282,304 in the same period, an increase of 1percent. Larimer County increased 1.6 percent, growing to 276,253 residents, while Weld County swelled 3.8 percent, topping 236,857 residents.

Boulder and Northern Colorado Population Growth

Posted by BoulderRealEstate at 7/01/2007 09:03:00 PM

Boulder's Farmers Market

Farmers Market A Vibrant Community Affair While many Colorado communities are home to farmers’ markets, few if any have sprouted into the twice-weekly event that the Boulder Farmers’ Market has become. The market near Central Park has, in fact, grown into a local institution, if you will, that is considerably more than a farmer’s market. It’s a place folks go for quality family time on a Saturday, or where adults take their friends or partners for a relaxing and unique evening out on Wednesday. Years before it moved to its existing location on 13th Street in 1986, the market was made up of four farmers who sold produce on the lawn of the county courthouse, said Mark Menagh, executive director of the Boulder County Farmers’ Markets. A grassroots movement to turn the small operation into a vibrant, community-oriented affair resulted in the move and, ultimately, the market’s expansion. Today, the market has 72 farmer members and 56 food contractors (local vendors who may not grow the base ingredient of their product, but make the product themselves). And all participants must sell their own products.

While many Colorado communities are home to farmers’ markets, few if any have sprouted into the twice-weekly event that the Boulder Farmers’ Market has become. The market near Central Park has, in fact, grown into a local institution, if you will, that is considerably more than a farmer’s market. It’s a place folks go for quality family time on a Saturday, or where adults take their friends or partners for a relaxing and unique evening out on Wednesday. Years before it moved to its existing location on 13th Street in 1986, the market was made up of four farmers who sold produce on the lawn of the county courthouse, said Mark Menagh, executive director of the Boulder County Farmers’ Markets. A grassroots movement to turn the small operation into a vibrant, community-oriented affair resulted in the move and, ultimately, the market’s expansion. Today, the market has 72 farmer members and 56 food contractors (local vendors who may not grow the base ingredient of their product, but make the product themselves). And all participants must sell their own products.

“We are a farmer-owned market,” he said. “If someone is growing something in Boulder County, we want them to be a member,” but only one food contractor offering any particular product is allowed to sell it at the market.

The growth of the market is also reflected in its revenue projections: Menagh expects the Boulder market to do more than $3 million in sales this year.

And in 2006, between 10,000 and 12,000 customers visited the Boulder market between 8 a.m. and 2 p.m. on one Saturday in July, he said.

The market has also changed in the kind of produce it offers, Menagh said. For instance, more farmers are growing organic produce on smaller acreages, resulting in a higher-quality product.

“Being able to look the farmer in the eye and say ‘how did you grow this’ is a huge benefit” for market shoppers, he said.

The cost of organic goods sold at the market may be higher than that found at a grocery store, “but you’re paying for quality,” Menagh said. And products grown the conventional way are also available at prices comparable or even less than supermarkets’.

The market attracts a “tremendous number” of chefs from the region who come to buy the best and freshest ingredients for dishes served at their restaurants, but also prevalent are the early morning regulars, tourists and late-comers hoping to snag whatever they can before the market closes.

Add 14 prepared-food vendors, serving up everything from sushi to pizza, pot-stickers to tamales, as well as children’s activities, musical entertainment, an occasional fine arts and crafts fair and charitable booths and you’ve got more than a farmer’s market – you’ve got a community festival that happens to run every Saturday morning and Wednesday evening from April through early November.

That makes the Boulder County Farmer's Market the first to open in the state and the last to close every year, Menagh said. In the early and late season, most of the produce is provided by greenhouse growers.

The market also has a Chef's Event, featuring Boulder’s world-famous chefs, which runs in conjunction with the fine arts and crafts show Aug. 18, Sept. 15 and Oct. 13 this year. Some of the other, regular offerings include fresh-baked goods from local bakers, fresh flowers, crafts created from things grown or gathered by the seller, T-shirts, canvas shopping bags and more.

Though Saturday’s market may be the busiest, the Wednesday market has grown 50 percent in the last two years, Menagh said. It offers the same produce as Saturday’s, but Wednesday’s produce was picked fresh that morning. The food plaza does as much business on Wednesday as it does on Saturday, and Wednesday customers are treated to a beer and wine garden at which they can sit down and chat with the farmers.

The food plaza does as much business on Wednesday as it does on Saturday, and Wednesday customers are treated to a beer and wine garden at which they can sit down and chat with the farmers.

The Boulder Farmer's Market is open 8 a.m. to 2 p.m. Saturdays through Nov. 3 and 4-8 p.m. Wednesdays through Oct. 3 at 13th Street between Arapahoe Avenue and Canyon Boulevard next to Central Park in downtown Boulder. For more information, visit http://www.boulderfarmers.org or call (303) 910-2236.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 7/01/2007 08:33:00 PM

South Boulder Price Increases

South Boulder price increases South Boulder is finding property price increases from 5 percent to 10 percent annually. RE/MAX of Boulder, Inc. follows real estate activity in the Table Mesa, Frasier Meadows, Park East, Baseline, Martin Acres, Majestic Heights and Devil's Thumb areas.

South Boulder is finding property price increases from 5 percent to 10 percent annually. RE/MAX of Boulder, Inc. follows real estate activity in the Table Mesa, Frasier Meadows, Park East, Baseline, Martin Acres, Majestic Heights and Devil's Thumb areas.

The inventory for these areas is about average for this time of the year and the percent of listings under contract to the amount of active listings is quite high - at 44 percent.

RE/MAX of Boulder projects a continuation of price increases in the 5 percent to 10 percent range. However, Boulder had price booms in '87, '94 and '98 and another boom could be coming where price increases hit 20 percent for a year or two. People wanting to live in Boulder as much as economic conditions in the nation will drive the bigger increases.

Another trend in South Boulder is remodels, “scrape-offs” and “pop tops,” especially in Martin Acres and Table Mesa. A “scrape-off” is when a home is razed and a new home built in its place, whereas a “pop top” is when an addition is built on top of the home. Homes that would have sold in the $300,000’s have been redone and resold in the $590,000 to $680,000 price range. In fact, one Realtor did this with a house in the area, purchasing it in 1988 for $86,000. The Realtor built onto the top of the home in 1992 and sold it in 1999 for $280,000. Then – just to keep it interesting – the Realtor bought it back 20 months later for $375,000 and is now reselling it for $590,000!

South Boulder certainly affords excellent potential.

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 6/01/2007 09:20:00 PM

Boulder's Mountain Market

Living in the mountains around Boulder Do you want to live in the mountains outside of Boulder? Are you looking for a home in the $600,000 to $900,000 price range? RE/MAX of Boulder, Inc. specializes in mountain properties. A wide range of homes are available and buyers will get more home for the dollar in the current market. Restrictions on new construction in the foothills and mountains of Boulder County can make it difficult to build the big, beautiful home you want, but you may find what you want in a resale home at these price points.

Do you want to live in the mountains outside of Boulder? Are you looking for a home in the $600,000 to $900,000 price range? RE/MAX of Boulder, Inc. specializes in mountain properties. A wide range of homes are available and buyers will get more home for the dollar in the current market. Restrictions on new construction in the foothills and mountains of Boulder County can make it difficult to build the big, beautiful home you want, but you may find what you want in a resale home at these price points.

The majority of buyers in the market are young, professional people who have the time, patience and financial status to take their time and find what they really want. That commitment of time and effort should bring people into the community who take pride in their homes and truly want to enjoy the mountain lifestyle.

community who take pride in their homes and truly want to enjoy the mountain lifestyle.

Potential sellers with houses valued up to around $500,000 should take heart in the fact that a limited number of homes in that price range are in the market. We all know that when the supply is low, the demand is high. If you are thinking of making a move, now is the perfect time to talk to a real estate professional and find out what this market can do for you!

By RE/MAX of Boulder, Inc.

Posted by BoulderRealEstate at 6/01/2007 08:59:00 PM