The Boulder City Council will soon hear the Planning Board's recommendations on a proposed "pops and scrapes" ordinance that limits the size of remodeled and new homes in established neighborhoods.

The ordinance addresses the issue of remodeling homes to increase their size as well as "scraping" of an old home to replace ("popping") it with a new, bigger home that doesn't fit in with the character of its established neighborhood.

The Planning Board’s recommendations, according to the Boulder Daily Camera, are more relaxed than what the city staff had suggested. Among the changes the board is recommending:

- Increase the floor-area ratio – the finished square footage of a house divided by the total lot area – allowed from the staff-recommended 0.45 to .5;

- Increase the allowable footprint of a home from the staff-recommended 30 percent to a 35 percent;

- Exempting barns, sheds or other structures from all restrictions, including floor-area ratio and footprint, if the city designates them as historic landmarks;

- Limiting restrictions to the Residential-Low 1 district, the zoning for single-family houses, and not including zones for mixed-residential and residential estates. The board suggests re-evaluating the issue after a year to determine whether to include other districts;

- Excluding 150 square feet of covered decks or patios not on front patios in floor-area ratios, whereas the draft ordinance also allows for 300 square feet of front porches;

- Increasing restrictions on wall length and design, adding rules for wall articulation and substantially increasing permit fees.

The City Council will have its first review of the proposed ordinance 6 p.m. Tuesday, Aug. 4, in the City Council Chambers, 1777 Broadway. The final review and vote is scheduled for 6 p.m. Tuesday, Aug. 18, at the same location. For more information about the proposed ordinance, visit the city of Boulder’s Compatible Development in Single-Family Neighborhoods Web page, http://ci.boulder.co.us/index.php?option=com_content&task=view&id=9051&Itemid=22.

To provide feedback on the proposed regulations, visit http://ci.boulder.co.us/files/PDS/compatible_development/comment_sheet.pdf or e-mail johnstonj@bouldercolorado.gov.

Board suggests relaxing house-size limits in proposed ‘pops and scrapes’ ordinance

Posted by BoulderRealEstate at 7/16/2009 10:21:00 PM

Boulder home prices remain steady in face of uncertainty

While many

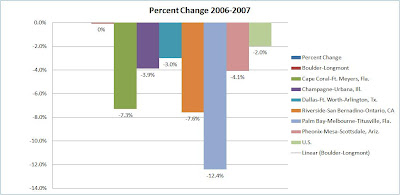

Recent numbers from IRES shows existing-home prices within the city of

Ken Hotard, vice president of public relations for the Boulder Area Realtor Association (BARA), attributed the local market’s strength to the absence of rapid appreciation of home values in past years that occurred along the nation’s coasts.

“We never really did have a bubble,” he says.

“Basic economics 101 will tell you that simple supply and demand plays a role here,” he says, noting

A recent study of

In other words, the city’s residents’ median income of $80,000 would not support the median home price, he says. In fact, 30 percent of all homeowners in the city of

Nonetheless, Boulder-area homes are not appreciating as much as they have in years past because of the slower economy and less job growth, Hotard says.

“There’s been some but there hasn’t been like there was in the ’90s,” he says.

From 1990 to 2000, the average appreciation of

Hotard says a 4 percent to 6 percent appreciation rate represents a healthy, sustainable market that makes purchasing real estate a wise long-term investment.

A 3 percent appreciation rate, though not as good, reflects a stable market, he says.

“That covers inflation,” Hotard says. “You’re not losing money but you’re not gaining much.”

Hotard predicts that the appreciation rate will remain stable and relatively unchanged until 2009 or 2010 in the absence of economy-impacting positive or negative events.

Once a new president and Congress are in place in 2009, it will take a while until it is clear how those changes will affect the real estate market, Hotard says.

Posted by BoulderRealEstate at 11/26/2007 09:51:00 AM